This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: How did the Opportunity Zone designation in the Nauck neighborhood come to fruition and what is the expected impact on the neighborhood?

Answer: Last year the U.S. Treasury, with the help of each state, began designating underdeveloped or “economically-distressed” communities as Opportunity Zones (OZ) to encourage residential and commercial development by offering investors preferred tax treatment. There are currently over 8,000 designated OZs around the country and 212 in Virginia.

Arlington’s Opportunity Zones

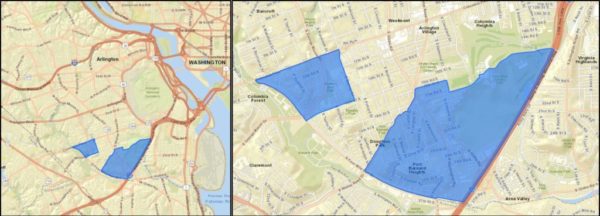

It may come as a surprise that there were two areas in Arlington that received OZ designations by the Governor/Treasury — Nauck-Shirlington Road and Barcroft-Columbia Pike. Both are located in the area bounded by Columbia Pike to the north, 395 and S. Four Mile Run (link to map and details).

Note: Although the zone is called Barcroft-Columbia Pike, part of it is actually Douglas Park and the rest is an area that I don’t think belongs to either the Barcroft or Douglas Park Civic Associations, but the apartment buildings there do take the Barcroft name.

On a national scale, I don’t think anybody would argue that these neighborhoods are economically-distressed, but within Arlington these designations should help stimulate or expedite development from South to North and West to East instead of the other way around. Both of these areas also have detailed planning documents in place to guide investors.

How Do Opportunity Zones Work?

OZs are a bit outside of my purview because they require commercial development and tax expertise, but the general idea is that investors will put money into Qualified Opportunity Funds and deploy capital to one or more projects in Opportunities Zones around the country in return for preferred tax treatment on their gains. The theme behind the OZs is encouraging long-term, sustained investment from these funds by incentivizing investments of 10+ years.

It’s important to note that OZs were first written into the tax code in December 2017 and while a lot of money has been raised by funds, there’s still uncertainty on how everything works. The last planned public OZ hearing between industry and Government was June 9 in which industry raised numerous concerns about the governance of the funds/tax exemptions, thus keeping a lot of the money sidelined.

The primary concern for industry seems to be around how the IRS will apply the tax code to different exit strategies common within commercial and residential development. Some investors are happy with any preferential treatment or willing to take the risk of not having an exit strategy, but many are understandably hesitant to deploy huge sums without a full plan in place.

What To Expect

You can expect the development in each of Arlington’s zones to follow the guidance of the 2004 Nauck Village Center Action Plan, 2018 Four Mile Run Valley Master Plan, and 2012 Columbia Pike Neighborhoods Area Plan.

The recently approved Nauck Town Square was the first step in realizing the Nauck area plan and much of the Columbia Pike plan is underway, including major commercial and public/utility improvements.

According to Arlington County’s project mapping website, there are not currently any proposals for major development within either of the OZs. However, the redevelopment of Centro Village (anchored by Harris Teeter), directly across from the Barcroft-Columbia Pike OZ, is nearly complete and the Trafalgar Flats condos, also directly across the street from the OZ, has done very well.

It’s quite possible that OZ funds have already been deployed in Arlington and we wouldn’t know. Given the impact Amazon is/will have on South Arlington, the Nauck, Four Mile and Columbia Pike area plans were going to take shape, but I suspect that the recent OZ designations will lead to a more rapid implementation of the County’s vision.

Investors in Arlington’s OZs likely fall into a category of investors who won’t wait for the Treasury to fully address all of industry’s questions before deploying capital because they’re content with any preferred tax treatment on investments that will be financially viable without the extra help.

Is this a fair implementation of tax incentives for a national program? Probably not.

Impact on Residential Real Estate

While the OZs themselves have a relatively limited supply of homes, the homes within and adjacent to these zones make-up the least expensive property in Arlington County. If you’re looking for growth opportunities relative to the rest of Arlington, I recommend adding these neighborhoods to your list, but plan on holding for 7-10+ years to realize the full benefit.

Tax benefits aren’t limited to commercial or multi-family property, but also apply to single-family homes. In some cases, there may be financial benefits to making substantial improvements (a requirement for preferred tax treatment in OZs) to rental properties located in OZs and holding them for 10+ years to qualify for the maximum tax benefit.

This may not work in Arlington because the cost of substantial improvements must be at least 100% of the adjusted basis (net cost) of the acquisition price within a 30-month period. Before considering this strategy for your next rental property acquisition, it’s critical that you speak with a tax professional well-versed in OZs.

I recommend Larry Bormel of Bormel, Grice & Huyett ([email protected]) for any tax-related OZ guidance.

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local real estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.