This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: How have rental rates on condos compared to appreciation in resale market value?

Answer: Last week, I compared the historical appreciation rate of different property types (tl;dr… single-family > townhouse > condo) so this week, I thought it would be interesting to drill into what a condo investment looks like in Arlington by comparing historical market value appreciation against historical rental rate appreciation.

1 BR vs 2 BR Condos, North vs South Arlington

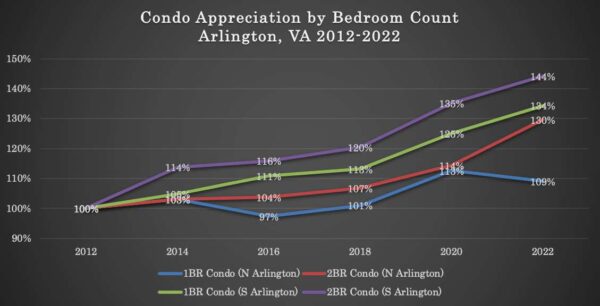

Last week we learned that, since 2012, condos in South Arlington have appreciated faster than similar condos in North Arlington and in both areas, a two-bedroom condo has performed better than a one-bedroom condo.

North Arlington Rental Rates Frozen, Moderately Higher in South Arlington

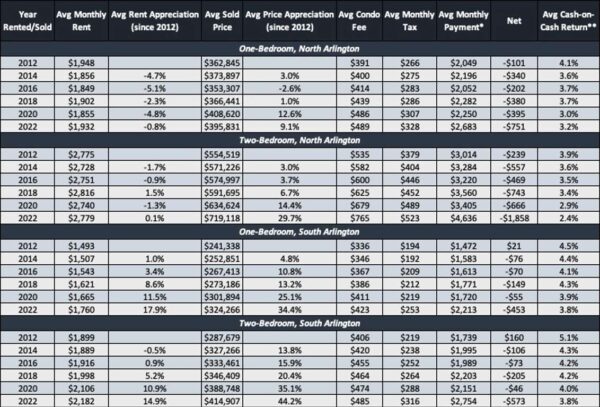

Incredibly, the average rent for a one- or two-bedroom condo in North Arlington has barely changed since 2012, while increasing about 18% and 15%, respectively, in South Arlington. I believe that is due to the high volume of new apartment buildings delivered over the last 10+ years, significantly increasing the supply of rents and delivering more modern finishes and amenities than most condo buildings offer, causing condo buildings, mostly built 15+ years ago, to become less desirable for renters.

It’s important to note that the rental data below is limited to what is in the MLS, which is mostly condo rentals, and does not reflect the commercial rental market, which has seen average rental prices increase since 2012.

*Calculated using that year’s average 30yr fixed interest rate (5.5% for 2022), 20% down, and $50 per month on homeowner’s insurance

**Approximate first year return on an all-cash purchase

Expect Low Return, Potentially Negative Cashflow

In most cases, real estate investments follow similar principles as other investments — more risk for higher return and lower expected returns for more stable investments. Arlington is one of the most stable, lowest risk real estate markets in the country/world and condos tend to have the lowest risk of all property types because they’re generally easy to rent with less exposure to costly repairs and maintenance oversights. Thus, you can expect shockingly (for some) low return on a condo investment in Arlington.

If you’re putting close to 20% down, expect to be cashflow negative for a while. If you’re paying cash, expect low single-digit cash-on-cash return. It’s important to note that the calculations above do NOT include vacancy periods (expect some between tenants), property management (usually ~6-10% of gross rent), maintenance/repair, and other expenses you may incur.

Where is the Payoff?

Investment properties come with significant tax benefits from depreciation and some other expenses (not mortgage interest) so for high earning individuals with few write-offs, the payoff for large tax deductions is substantial and can offset monthly cashflow losses. If you are financing the investment, you must consider the unrealized gain of principle buydown (unrealized until you sell) and incorporate that into your return-on-investment calculations.

Also keep in mind that these are blended averages of one- and two-bedroom condos. If you are exclusively seeking an investment property, you will find some properties with moderately better projected returns by focusing less on what you want to live in and more on value.

Many people end up with a condo investment property because they’ve bought it for their primary residence and then convert it into a rental property when they move out. This can be an excellent way to build your investment/real estate portfolio because you get a lower interest rate on a primary residence, with the ability to put less than 20% down, and generate value just by living there and not paying rent yourself.

Condos are, of course, not the only option when it comes to real estate investing but they tend to be the most accessible, and thus, the most popular. Investing in real estate can be a great way to build wealth, but you must first understand the risk-return profile you want and be realistic about costs, returns, and the time you’ll spend managing the investment.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460