A project to redevelop the Key Bridge Marriott building appears to have stalled with no indication of picking back up.

That may be related to signs of financial distress for the property owner and developer, Woodridge Capital Partners.

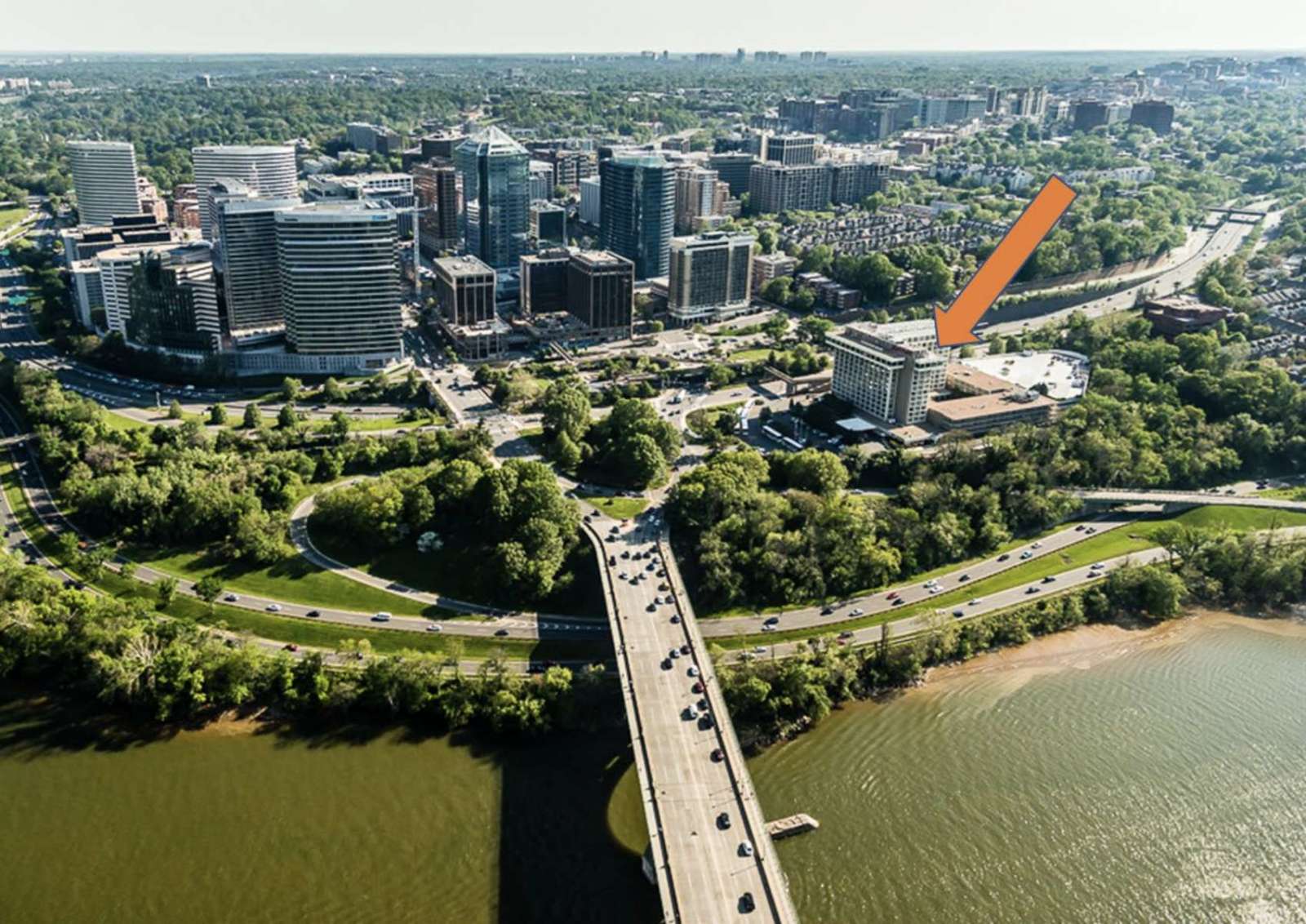

The Arlington County Board approved the project at 1401 Langston Blvd in Rosslyn — on a prominent plot of land overlooking the river and parts of D.C. — on March 24, 2020. The applicant, Woodridge affiliate KBLH, LLC, proposed to partially demolish and renovate the existing hotel and construct two new residential buildings: one with 151 condo units and one with 300 apartments.

Six months after the Marriott shuttered the hotel in July 2021, the Washington Business Journal noted no signs of progress on the project. ARLnow checked permit records and found only one new permit has been filed since, back in February 2022.

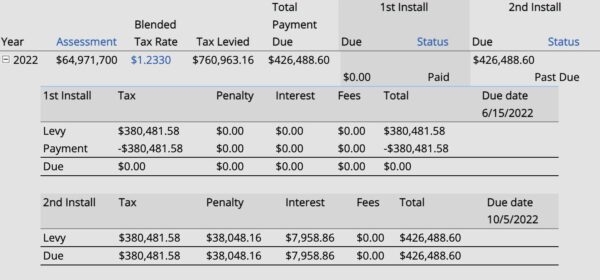

Meanwhile, a search of property records indicates Woodridge is behind on its 2022 real estate taxes, owing $426,488, which was due in October.

Evidence of a worsening financial situation for Woodridge is stronger on the West Coast. In Los Angeles, where the company is based, it undertook a $2.5 billion redevelopment project to convert the top two floors of an iconic hotel in Los Angeles, the Fairmount Century Plaza Hotel, into expensive condos. It also built two 40-story condo towers on the site, with units costing $2-12 million.

Woodridge finished the renovated Century Plaza hotel in the middle of the pandemic and the condo towers last summer, as L.A.’s housing market began to falter. It had managed $200 million in presales in 2019.

Now, an affiliate of Woodridge called Next Century Partners is set to lose its stake in the project via a foreclosure auction scheduled for Dec. 14, commercial real estate data group CoStar reported.

Farther north, a ritzy hotel in San Francisco’s Nob Hill neighborhood, owned by Woodridge, closed after the company defaulted on a $56 million loan from Deutsche Bank.

Woodridge did not respond to requests for comment. Oaktree Capital, an affiliate of one of the project’s backers, declined to comment.

“The only upcoming groundbreaking Woodridge will be involved on is one that will find it beneath a patch of clover,” a reader quipped in a tip, suggesting that the project may need to change hands to move forward. “Next developer please!”