Households of color face significant barriers to homeownership, according to a new report from Arlington County.

A division of Arlington’s planning division, Housing Arlington, conducted the study to understand trends in the local homeownership market. The report, released earlier this fall, was the first step in a multi-phase homeownership study that kicked off this summer.

It follows on the heels of the Missing Middle Housing Study, which identified a number of low-density housing types that could be added to Arlington’s housing stock. The result of this study was a series of proposed zoning changes intended to encourage their construction beyond where it is currently allowed and, possibly, lower home prices.

“We know that the benefits of homeownership are exponential and home ownership is one of the most effective ways to build generational wealth in this country,” said county planner Akeria Brown, discussing the report in a recent Housing Commission meeting. “We also know that many households, minority households in particular, were not or traditionally have not been afforded opportunities to be able to purchase in this environment.”

Racially restrictive deeds excluded certain racial and ethnic groups, particularly Black people, from certain neighborhoods last century, while certain zoning policies, at least to an extent, had the same practical effect. Arlington County maintains that there is a strong relationship between these older policies and today’s lack of homeownership opportunities for households of color.

While the county has a number of programs to help people earning below 80% of the area median income access homeownership, such as by providing counseling and helping households make down-payments, the aim of this study is to gauge their efficacy, improve them and potentially launch new ones.

“We want to look at ways to support moderate-income households to be able to build generational wealth, to build that long-term housing and financial stability and take advantage of incentives that go along with home-ownership to right some of those issues that have occurred along the way,” Brown said.

Before staff could do that, they needed to go beyond the data points showing lower homeownership rates among households of color.

Staff cited data showing that banks are less likely to lend money to Black and Hispanic borrowers when they are buying a home or refinancing.

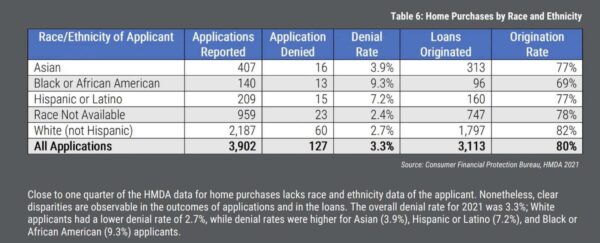

Black and Latino households had the highest mortgage application denial rates, 9.3% and 7.2%, respectively, compared to non-Hispanic white borrowers, 2.7%, and those of Asian descent, 3.9%.

“The leading reason for loan application denial in 2021 was insufficient income to meet lender requirements, followed by incomplete credit applications and credit history issues,” the county report said.

Black and Latino households also obtained 30-year loans with higher interest rates than other borrowers on average.

About two-thirds of mortgages originated in 2021 were for refinancing existing homes when interest rates were low. Application denial rates were higher across the board, but still divided along racial and ethnic lines.

Interest rates were higher in relatively lower income neighborhoods including Buckingham, Halls Hill, and Glebewood, as well as the western portion of the Columbia Pike corridor and the Columbia Heights neighborhood.

In addition, homeownership rates are lowest in Arlington’s three historically Black neighborhoods, noted Mike Hemminger, the incoming president of the Arlington branch of the NAACP, in the meeting.

The county has to be intentional about reversing this trend, Alice Hogan, who sits on the Board of Directors for Arlington Partnership for Affordable Housing, said in the meeting.

“It’s not just about making ownership an option,” she said. “What is the demographic makeup of the folks who are going to achieve that ownership if we really want to get to the equitable piece of this?”