This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: What are current forecasts for mortgage rates in 2023 and beyond?

Answer: Happy New Year everybody!

A few weeks ago, I posted a “Beyond the Headlines” deep dive with James Baublitz, VP of Capital Markets at First Home Mortgage, into why interest rates have increased so much.

As the calendar turns, many of you will be kicking off your home search and asking about current and forecasted interest rates, so I’ll cover that today, plus a quick note on recent loan limit increases for down payments as low as 3%.

What is a “Normal” Mortgage Rate?

The first thing to understand about mortgage interest rates is that they are market-driven and forecasting comes with the same amount of unpredictability as any other economic/market-based forecasting (GDP, Unemployment, Stocks, etc). Take predictions/forecasts with a grain of salt.

The other truth that is best illustrated by the chart below, which shows the average 30yr fixed mortgage rate since 1971, is that there really is no established “normal” interest rate that we can point to and say “this is what you can expect when markets stabilize.” So, use caution when relying on assumptions about future rates (e.g. for a refi).

Forecasting Future Rates

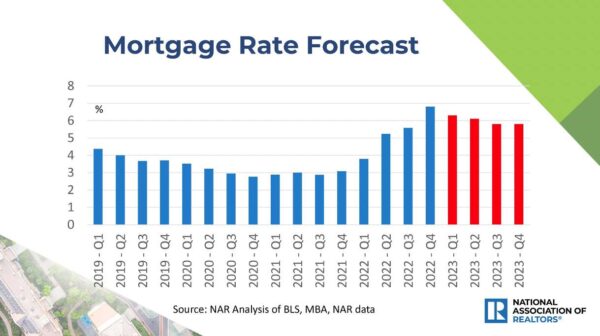

Most major forecasting organizations including Mortgage Bankers Association, Freddie Mac, and National Association of Realtors (NAR) believe rates will steadily decrease through 2023 and that trend will continue into 2024.

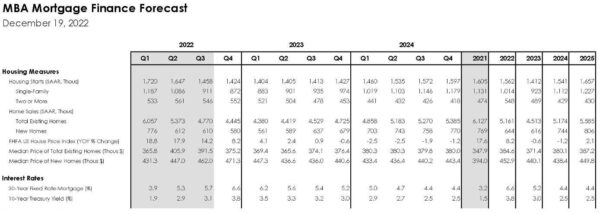

Mortgage Bankers Association expects rates to fall faster than Freddie Mac and NAR, with average 30yr fixed rates hitting mid 5s by the 2nd quarter and low 5s by the end of 2023. They forecast that rates will be in the 4s by Q1/Q2 2024 and believe the long-term stable rate to average 4.4%.

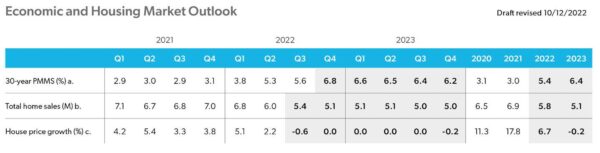

Freddie Mac sees rates remaining in the mid 6s for most of 2023 and closing out the year at an average of 6.2%.

NAR expects the average 30yr fixed rate will hover just above 6% in the first half of 2023 and then settle into the upper 5s in the second half of the year:

Higher Loan Limits for Lower Down Payments

The Federal Housing Finance Agency (FHFA) just released new conforming loan limits for 2023, with significant increases to reflect recent price growth. The jurisdictions in the greater D.C. Metro area were given the maximum loan ceiling of $1,089,300.

Beginning this year, Fannie/Freddie will insure loans up to $1,089,300 with as little as 5% down, or the equivalent of a purchase price just under $1,150,000 with 5% down. The new conforming limits increase the maximum loan amount with 3% down to $726,200, or the equivalent of a purchase price just under $749,000 with 3% down.

For any conforming loan (or any loan for that matter), borrowers must also qualify on several factors including credit score, debt-to-income ratio, first-time buyer status, and more. Feel free to reach out to me for lender recommendations if you’d like to explore your mortgage options.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460