This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: How is the real estate market through the first quarter?

TL;DR (1:33)

Answer: “How’s the market?” Well, technically, that answer depends on what market you’re talking about — location, property type, price point, etc. but for this column, I’ll provide an overview of what we’re generally seeing in the Arlington/Northern Virginia/D.C. area market these days.

- The market is competitive

- Demand is moderately high

- New listing volume is historically low

- Rates (Hopefully) Heading Down

- Ignore National Data

The Market is Competitive

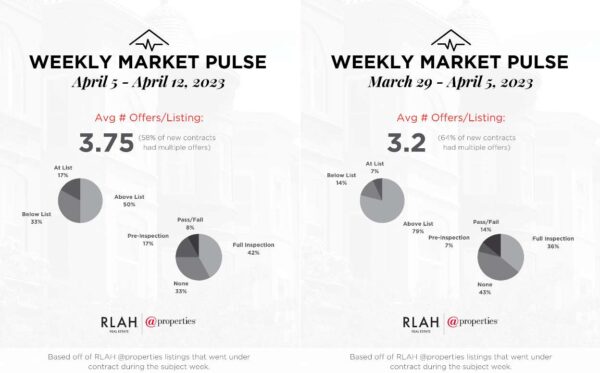

Multiple offers, escalations, and reduced or no contingencies are common.

The data visualization below is from the listings that went under contract each of the last two weeks at our brokerage, RLAH @properties, of ~400 agents in the greater D.C. Metro area.

Demand is Moderately High

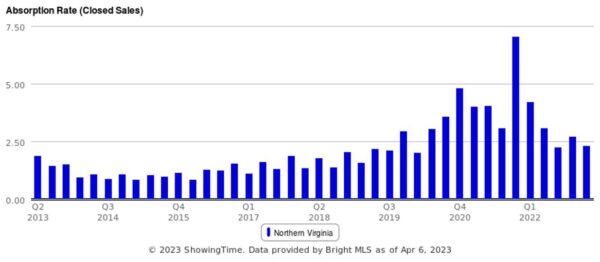

Demand is lower now than it was from late 2020 through early 2022, due to high interest rates.

The chart below shows the quarterly absorption ratio for Northern Virginia over the past decade. A higher ratio equals higher demand. We’ve fallen slightly from the post-Amazon HQ2 year (this was primarily driven by the condo market) and Covid buying years, but demand is still well above the “norm” established from 2013-2018.

New Listing Volume is Historically Low

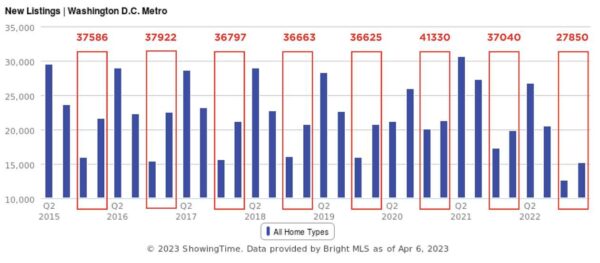

The lack of new listings is driving competition, not high demand.

The chart below highlights the dramatic drop in new listing volume for the D.C. Metro area for Q4 and Q1, with about 10,000 fewer homes listed for sale during the most recent Q4/Q1 compared to previous years, or a ~25-30% drop for most D.C. area localities.

Rates (Hopefully) Heading Down

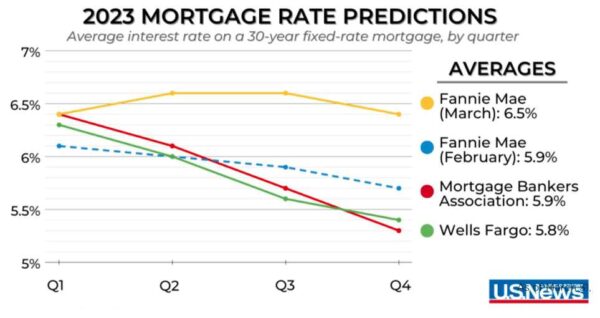

Inflation data suggests we’re heading firmly in the right direction and that puts downward pressure on interest rates. However, turmoil in the banking sector (SVB Collapse, commercial building loans) has caused demand for mortgage-backed securities to drop thus putting upward pressure on interest rate pricing.

Here’s a collection of some of the most recent interest rate forecasts through 2023:

Ignore National Data

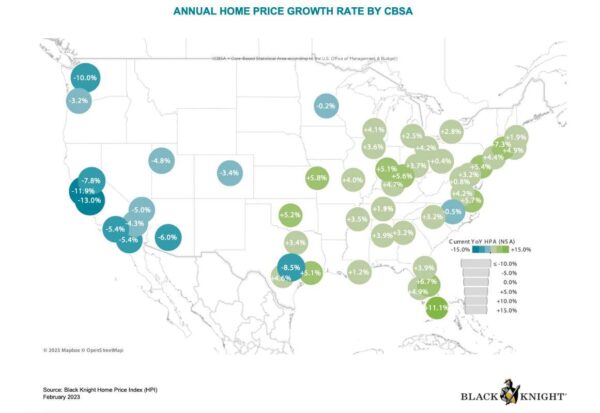

Different markets, especially west coast (struggling) vs east coast (appreciating), are seeing very different data and make national data pretty useless to the individual homeowner/buyer.

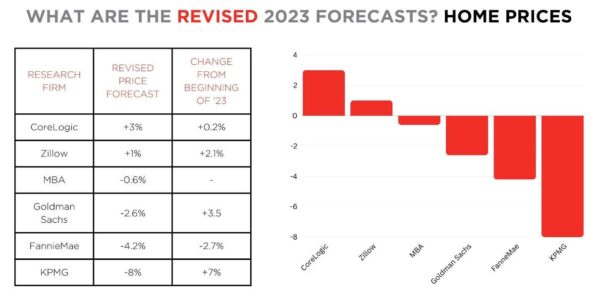

The charts below show the wide range of national real estate price forecasts and a chart showing performance for major regional real estate markets around the country. Notice the variation between regional markets and you can understand why combining all of that data into one national pricing datapoint isn’t helpful.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460.