This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: Do you have any recommendations for ways to reduce the burden of high interest rates?

Answer: Hearing somebody suggest an interest-only mortgage may initially sound like a gimmick and bad financial advice, but for some buyers, an interest-only mortgage might be a great option to responsibly purchase more house within budget, with more control over your payments.

I was recently discussing mortgage options for a client with Skip Clasper of Citizens Bank ([email protected]) and he brought up their interest-only mortgage product so I thought I’d share it here in case it can help anybody else. Most banks attach a higher interest rate to their interest-only product, but Citizens Bank does not (currently).

Standard Mortgage vs Interest-Only

A traditional mortgage is designed so that every payment is a combination of interest and principal, so that the loan is fully paid off after 30 years if you make the same minimum monthly payment each month. In the early part of the loan, most of your payment goes towards interest.

An interest-only mortgage is a loan that does not include any payment towards principal with each minimum monthly payment and thus lowers the amount you pay each month. Any money you pay over your minimum monthly payment goes directly towards principal and you can choose when and how much to make those extra payments. Note that in a standard mortgage, you can also pay additional money towards principal at any time, but you must make the minimum payment, which includes interest and principal.

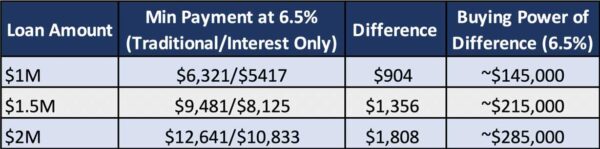

The difference in payments between the two products isn’t massive because so much of your initial payments on a traditional mortgage are interest, but you can see from the table below that the difference in payments is enough to move most buyers into a new pricing tier (better/bigger home) or to become more competitive in the price tier you’re in (better chance of offer being selected). The table below doesn’t contain a $500k loan amount because the interest rates on lower loan limits are usually too high to justify.

Who Should Consider an Interest-Only Loan

There are a handful of buyer profiles that I think should consider an interest-only mortgage to give themselves more spending power and/or more control of their loan payments:

- Professionals with high bonus/commission compensation structures like attorneys, partners/executives, salespeople, and business owners. The key is making sure that you are allocating money from these windfall bonus/commission payments towards paying down your principal, but it helps keep your cashflow more manageable during the months where you have less or no income.

- Homeowners who have high short/mid-term expenses like childcare. A family with two young kids in childcare may be paying $4,000+ per month and for most families, that cost will go away within a couple/few years. Once those costs drop off your budget, that money can be redirected into paying down the principal, if you haven’t yet been able to refinance into a lower interest payment.

- Buyers where a new job or promotion is highly likely within a few years that will cause your income to increase enough that can start paying down the principal and make up for lower, interest-only payments early on. A good example of this is a couple where one person works and the other is in grad/medical school.

- Buying a “forever home” and you’re finding yourself coming up a short on the budget you need to get into the right home and you don’t want the difficulty of managing higher payments in the first 2-3 years to prevent you from buying what you need for the next 20-30 years. There must be a reliable way for you to be able to be able to start paying down the principal (and catching yourself up) after a few years.

Waiting for Interest Rates to Drop to Refinance

A lot of buyers in today’s market are taking on higher mortgage payments than they can’t afford long-term and counting on interest rates to drop in a year or two so that they can refinance. While the odds are good that there will be a refi opportunity in the next 12-24 months, it’s far from certain and if you can’t sustain your minimum required payment on a traditional mortgage for more than 12-24 months, you’ve got a problem.

For buyers who are willing to take a gamble on a refi, an interest-only loan may be a safer way to wait for rates to drop because if it takes longer than expected, you have more control over how you pay down your mortgage prior to rates dropping enough for a refi.

Fiscal Responsibility is Key

The key to using an interest-only loan is to use it responsibly and have a solid plan in place to make payments towards principal rather than waking up 8-10 years into your loan payments with little to no dent in your loan balance (principal). If you do not trust yourself to do this, don’t even consider taking on an interest-only mortgage.

Qualifying is More Difficult

Interest-only mortgages are a riskier product for banks, so the lending standards are higher than a traditional loan. For most banks, you must qualify based on a 20yr amortization payment scheduled instead of a 30yr, meaning your debt-to-income ratio must be a lot stronger. Most banks also require you to have a significant amount of reserves after closing (retirement funds can usually be applied) and you need at least 20%-25% down.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C A