This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: Are there any techniques I can use to understand how much to offer and/or pay for a home? How often do people pay above the asking price?

Determining the right offer and purchase price for a home is a combination of analysis and feel. Here are some of the steps I take when arriving at these numbers:

Comparable Sales (aka Comps): This is the most common and analytical way of determining fair value. It’s also how most sellers come up with the list price. Comp analysis is the practice of reviewing the sales price of similar/comparable homes to come up with the market price of the subject home. The criteria, geographic location, and amount of time you look back (e.g. 6 months vs 2 years) are dependent on the subject property and the availability of “good” comps. For example, if you’re buying a 1BR condo in a large building, there’s a good chance you can find a few nearly identical sales going back only 6 months. If you’re buying a large custom-built home surrounded mostly by homes of different size and style, you’re going to have to get a little creative in your search.

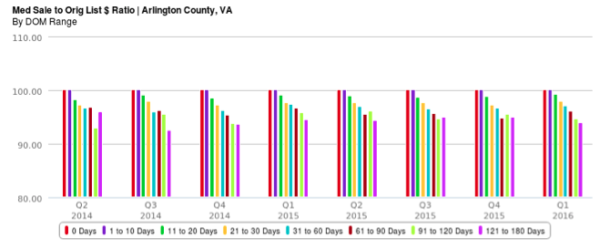

Days on Market: Days on Market (number of days a property has been listed for sale) is a great place to start when discussing a discount from list price. The longer a home sits without a contract, the higher the opportunity for a discount from the list price. I’ll let the following graphic of quarterly home sales in Arlington explain. Note: 100% means the buyer paid full ask, 95% means they paid 5% under ask. Each bar represents a range of days on market when the property went under contract.

Seller Preferences: It’s important to find out if there’s anything other than sales price that’s important to the seller. Sometimes they’d like a rent-back period to give them time to purchase their next home or they have school-age children and don’t want to sell until the school year is over. Being aware of and accommodating these preferences creates a great opportunity for buyer savings.

Buyer Preferences: The right price isn’t always based on fair market value, but also what you, the buyer, wants. Have you been searching for months and this is the first home you found something that feels like “the one?” Are you only planning to live there for 2-3 years before buying your next “forever” home and more interested in getting a good deal than the perfect fit? You need to ask yourself how you’ll feel if you make a low offer, dig in on negotiations, and end up losing out to a buyer who submits a better offer during your negotiations. The bigger the discount you’re targeting, generally, the longer the negotiation period and more exposure to competitive offers.

Paying Over Asking Price: Sometimes it’s necessary to pay above the asking price in order to get the right home. Paying above the asking price is difficult for many buyers to accept, but is more common than you’d think. Out of 2,854 standard sales (non-foreclosure, short sale or bank-owned) in Arlington in 2015, 475 or 16.6% went for over the list price (factoring any seller credits in). The largest premium paid was 14.3% over ask, the median days on market was 5 days, and 420 of the homes sold over ask were on the market for 10 days or less.

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at http://www.RealtyDCMetro.com.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.