This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: What has been the impact of the Coronavirus/COVID-19 on the real estate market?

Answer: I hope you and your families are healthy and finding some productive ways to remain safely at home. It’s been great to see so much carryout and delivery activity at local restaurants, I hope we can keep our favorite establishments in business.

I want to shout out the Sunday evening manager at the South Arlington Ledo Pizza for the way he was expressing constant, sincere appreciation to every employee hard at work and each customer who came in. It was refreshing to hear such positivity.

This week I’ll cover some real-time market updates and take a look at how past recessions have impacted real estate.

March 30 Stay At Home Order — Executive Order 55

Yesterday afternoon, Governor Northam announced EO 55, at Temporary Stay At Home Order due to COVID-19 to further discourage gatherings and personal contact.

There was an immediate concern across the real estate community that the new order effectively shut down all real estate operations, but soon after Northam’s announcement, the Northern Virginia Association of Realtors (NVAR) and the Virginia Association of Realtors (VAR) announced that under EO 55, real estate business may continue to operate using best practices for social distancing and other measures recommended by the CDC, as well as avoiding any gatherings of 10+ people. Here is a link to the official NVAR comments.

That means that as of this morning showings, inspections, appraisals, closings, lending and other activities critical to a real estate transaction are all still allowed in Virginia/Northern Virginia. Public Open Houses are strongly discouraged and many companies have suspended them.

Personally, I think showings are the most questionable activity because you can make a strong case in both directions. If somebody needs to find a home, it’s fair to say that they need to see the home in person before making an offer. On the flip side, somebody seeing five properties on a Saturday afternoon to prepare for a purchase 6 months from now should not be out on showings. There’s certainly a level of personal responsibility required here.

Arlington Market Update

It seems that much of the Arlington and Northern Virginia market has softened in the past week. This is based on further decreases in showing activity and the negotiations I’ve been directly involved in or aware of via colleagues. We won’t have actual price data available for another 3-4+ weeks when homes start closing that were placed under contract during the COVD-19 lockdown period.

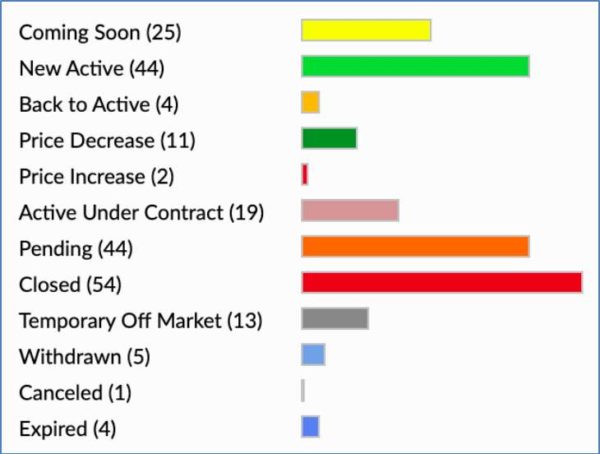

New inventory continued to flow into the market, but was down from the previous week. A healthy 63 homes went under contract, showing that there are still buyers out there, but many of them are likely securing better terms than they would have a month ago, and facing much less competition.

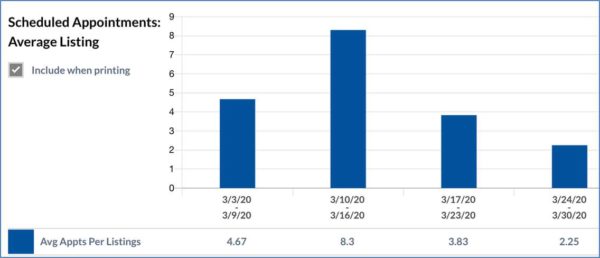

Showing activity is unsurprisingly very low, with the average showings per listing dropping to 2.25 over the past week. With an average of about 15 showings before a ratified contract, expect average days on market to start increasing. However, the showings that are taking place tend to be to ready-buyers so it should take fewer showings than it used to for the right buyer to surface.

Real Estate During a Recession

The economy is in bad shape and it could get a lot worse. It’s way too early to make any predictions about the real estate market 6-24 months from now until we know just how long Coronavirus will keep businesses closed and consumers at home.

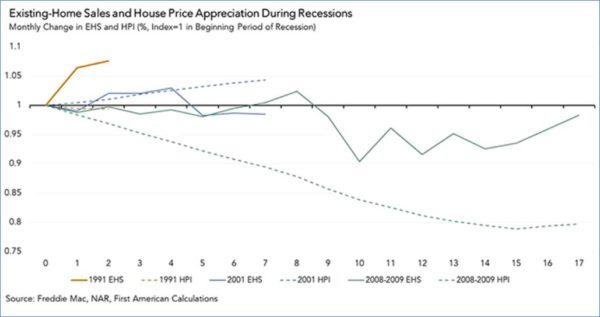

What we can do is look at the real-time/near-term impact (what I’m trying to cover every week) and what’s happened in past recessions. The 2008 crisis crushed real estate across the country (Northern Virginia/D.C. Metro fared relatively well) and is fresh on everybody’s minds, but it’s important to note some key differences between the Great Recession and other down markets.

First, that was a mortgage-based crisis so the real estate industry was hit directly. Second, prices were up despite high supply because demand was artificially high due to absurdly irresponsible lending practices that allowed people to buy much more than they could afford via low/easy entry into loans.

Mortgages over the last decade are much more conservative than the mortgages that led to the Great Recession. There are strict debt-to-income and credit limits, and predatory products/practices like zero interest balloon loans are all but eliminated from the market.

So the recent price appreciation is driven by a more natural supply/demand curve. Low supply because we’ve run out of land to build on and strong demand from much more qualified borrowers.

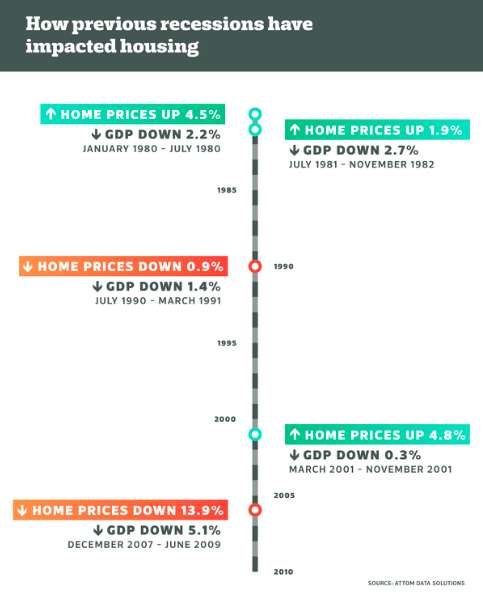

In three of the last five recessions, housing prices actually increased, as illustrated by the chart below from Attom Data Solutions and in a similar study by First American of the last three recessions, showing the dramatically different impact the 2008 crisis had on housing prices compared to other recessions.

Conclusion

I want to be absolutely clear that I’m not suggesting everything is going to be fine or that the real estate market won’t take a significant hit. That type of messaging from real estate “professionals” irks me almost as much as the idea that a market can simultaneously be great for buyers and sellers… that’s not how markets work (can’t help myself from the Esurance meme)!

It seems almost certain that negotiation leverage will favor buyers over the next 4-6 weeks. The critical question is whether or not buyers will have even more leverage months from now or whether markets will begin stabilizing, then return to the hyper-competitive market we had just a month ago.

The fact is that we have never experienced a complete economic shut-down like this, nor do we know how long it will last, and economic/real estate forecasting models aren’t tuned for this. It’s still too early to say with any level of certainty right now what the mid/long-term fallout will be for real estate or any other industry.

Be smart, be careful, be strategic. And stay home!

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local real estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington D.C., and Maryland with RLAH Real Estate, 4040 N. Fairfax Dr. #10C Arlington, VA 22203, (703) 390-9460.