This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: How much has the market changed in the last six months?

TL;DR (0:56)

Answer: Sometimes I write columns for myself as the audience, this is one of them… I hope some of you find it as interesting as I do!

Four months ago, you couldn’t watch/read the news without hearing about the collapsing real estate market but by late January, it was obvious that low supply would prevent that from happening. Demand even prevailed through February rate spikes because 2023 was the first year that new listing volume in February was lower than January.

Market Whiplash from Q4 ’22 to Q1 ’23

It’s normal for the market to slow in Q4 and pick back up in Q1, but the change in market conditions from Q4 2022 to Q1 2023 was the most significant on record.

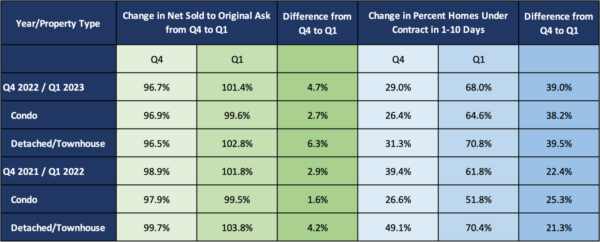

To get a sense of just how much of a shift we experienced between Q4 and Q1, I compared the key performance metrics of Net Sold (sold price less seller credits) to Original Asking Price percentage and the percentage of homes going under contract within ten days. I also compared all property types, condos, and detached/townhouse/duplex. Here are the highlights:

- Buyers lost about 6.3% of negotiation leverage on non-condos since Q4. I think that percentage accurately represents how much the market value of most non-condo properties has changed in just a few months.

- The performance data for non-condos is surprisingly similar for Q1 ’23 and in Q1 ’22, despite 2022 being the hottest market we’ve ever experienced.

- Market pace in Q4 was really slow, with less than 1/3 of non-condos going under contract within ten days. In Q1 that number has jumped to almost 71%.

- The condo market in Q1 ’23 is notably more competitive than it was in Q1 ’22, despite last year’s favorable market conditions (low rates). It took buyers a while to put the pandemic-led resistance to condos behind them, but it’s now clear that condo demand has returned.

Looking ahead, it doesn’t seem like there’s any supply relief in sight, with new listing activity trending at 10-20+ year lows so even moderate demand will create upwards pressure on prices and a fast-paced market. However, you can expect demand to ease up as summer approaches and you can always count softer demand in Q4.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460