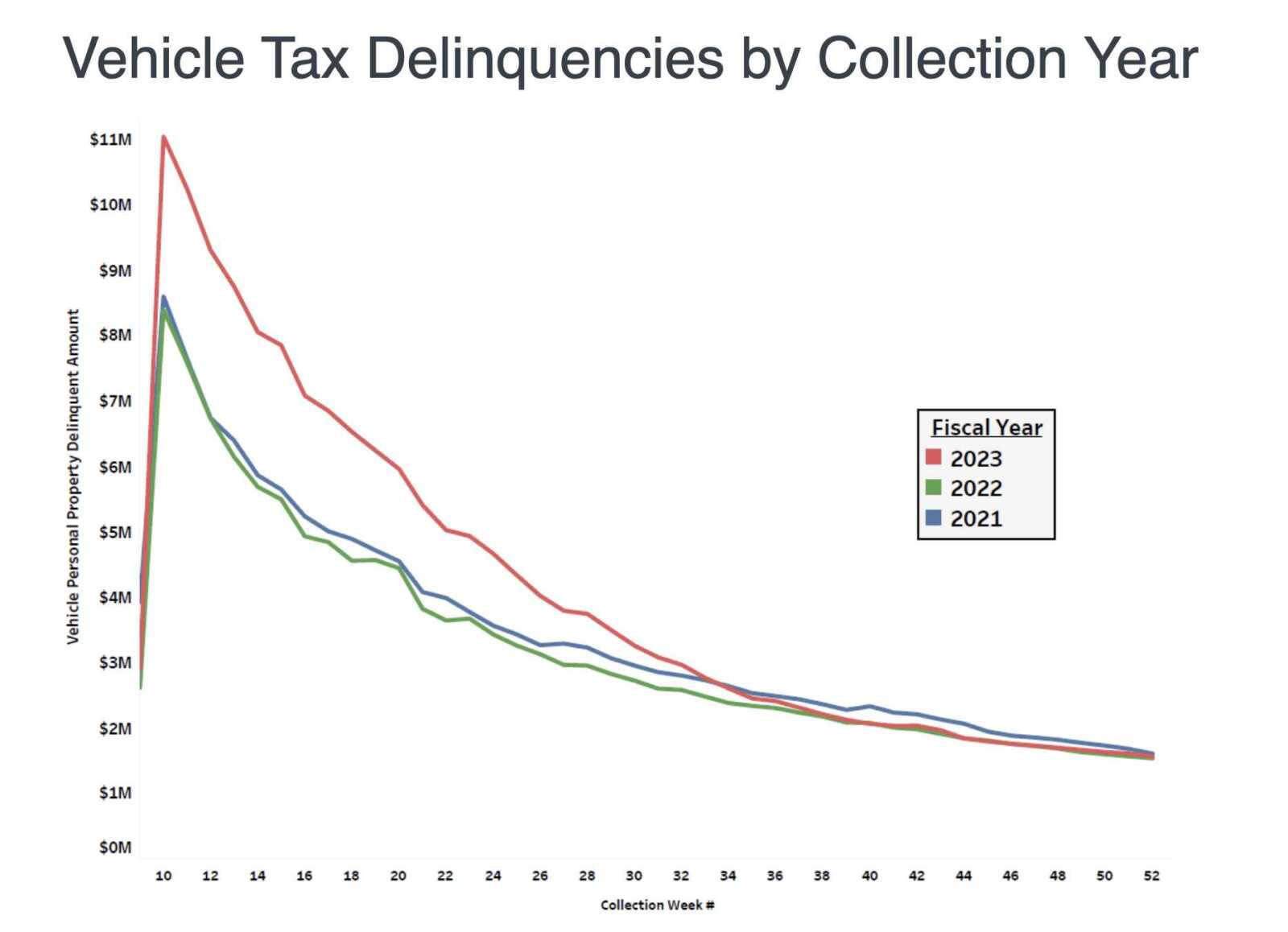

Last year’s soaring car tax values resulted in more people behind on their vehicle taxes, according to Arlington’s Treasurer.

Despite the uptick, Arlington County ended the 2023 fiscal year with historically few people behind on their taxes, Treasurer Carla de la Pava told the Arlington County Board on Tuesday.

The county closed out the fiscal year on June with the lowest delinquency rate in its history: under 0.16%.

Car assessments are determined by the office of Commissioner of Revenue Ingrid Morroy, weighing several factors including oil prices and supply-chain issues.

Bucking a century-long “depreciation pattern,” vehicle values — especially for SUVs, trucks and hybrid and used vehicles — rose last year due to widespread pandemic-era car shortages, Susan Anderson, a spokeswoman for the Office of the Commissioner of Revenue, tells ARLnow.

“Covid-19 had the largest impact when vehicle production and supply lines collapsed,” she said. “New cars were in tight supply and the laws of supply and demand were in full effect. Production of less-new cars available at elevated prices from dealers had a cascade effect on the used car market driving up prices.”

In response, the County Board in 2022 adopted a one-year-only reduced assessment rate at 88% of the clean trade-in value of vehicles. Despite this, the Treasurer’s Office, which collects the vehicle taxes, “still saw the highest tax delinquencies not just since the pandemic but the highest since the fallout of the Great Recession in 2008,” de la Pava said.

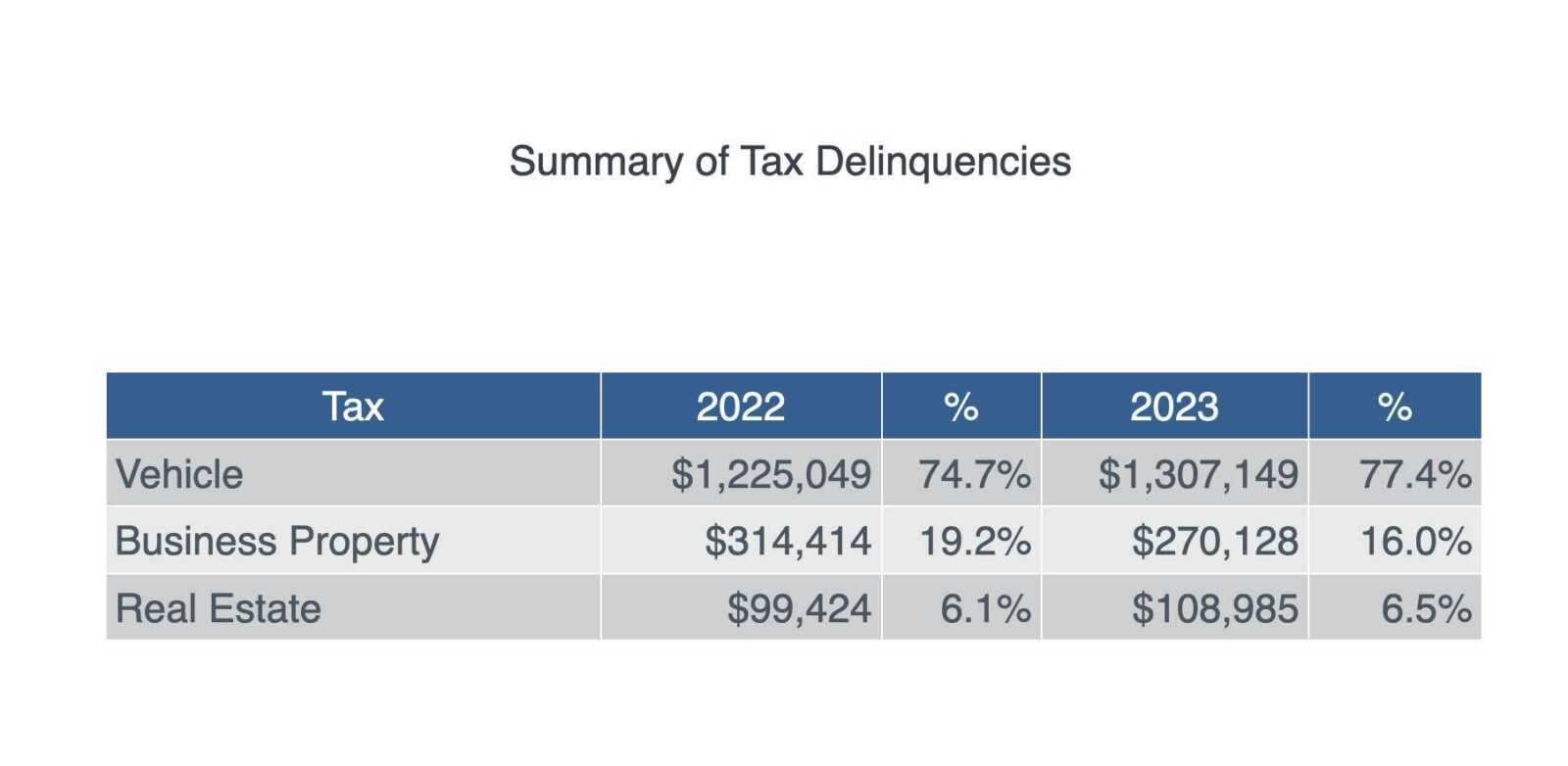

Taxes levied on vehicles make up the lion’s share of delinquencies, or 77% of the total delinquencies at the end of this fiscal year. Vehicle tax delinquencies went up 33% despite a far smaller increase in delinquent accounts, 3.4%. Almost half of these delinquencies involved vehicles worth at least $20,000.

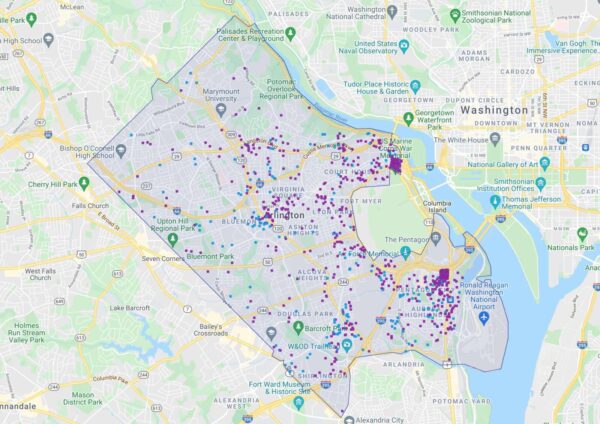

Most delinquent accounts were opened the year prior and are concentrated in densely populated, highly transient areas, de la Pava said, which she attributes to new or short-term residents unaccustomed to a vehicle tax. Her office also hears from residents surprised their taxes went up after buying a new car.

The treasurer credited the 2022 reduced rate and delinquency prevention efforts for avoiding a surfeit of delinquent vehicle owners.

Compared to vehicle taxes, real estate taxes make up most of 88% of taxes levied and only 6% of delinquent taxes.

Delinquencies for the business tangible tax — for furniture and equipment inside businesses — were half a million dollars higher last fiscal year, compared to the year prior, though still lower than pandemic years, she said.

De la Pava credited the county’s online payments system for helping to keep a lid on delinquencies.

“People ask me all the time: ‘How is it that we have such a low tax delinquency rate?'” she said. “Delinquency prevention is a big part of that. The Customer Assessment and Payment Portal, otherwise known… as CAPP, is one of the most important tools we have to prevent delinquency.”

Automated withdrawals via CAPP made up $51 million of the taxes Arlington collected, she noted.