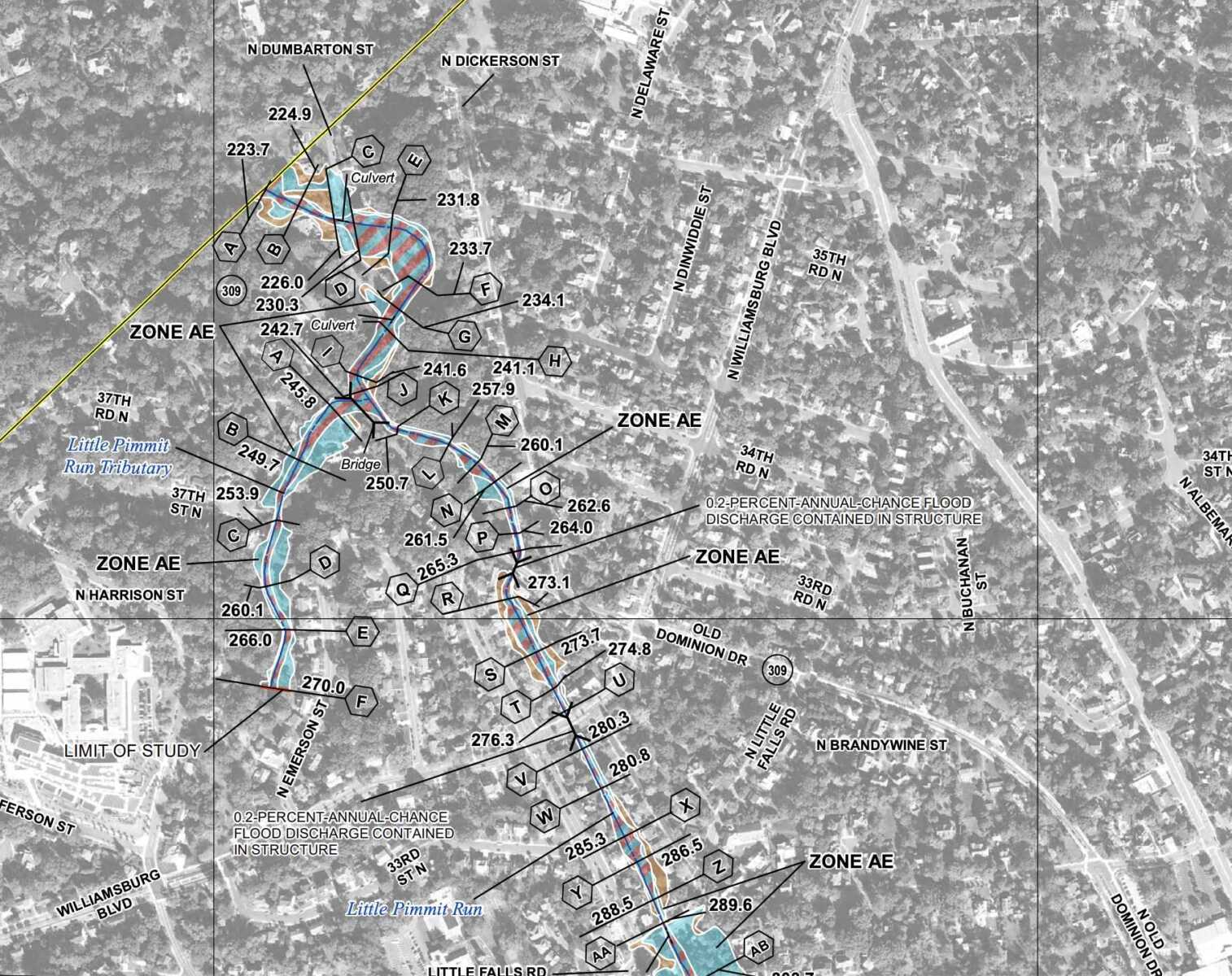

More Arlington properties could be impacted by 100- and 500-year floods, according to new federal flood insurance rate maps.

The county estimates some 300 buildings, up from 172, now risk a 1% annual chance of being inundated by floods expected to happen once a century. Another 1,150 parcels, up from 1,054, face a 0.2% annual chance of floods that come around every half-millennia.

It identified the probable increase after comparing existing and new floodplain boundaries drawn by the Federal Emergency Management Agency.

In 2020, FEMA proposed new floodplain boundaries and approved them this May, giving Arlington six months to adopt the changes or get booted from its program providing flood insurance to residents, according to a county report.

FEMA also declared emergency services, healthcare facilities and government records storage could no longer be located within 500-year floodplain boundaries, while accessory structures within 100-year floodplain boundaries have to be smaller than 600 square feet and only used for vehicle parking and storage.

Lastly, it created the option, which Arlington is taking, to require greater flood-proofing for the lowest level of structures in 100-year floodplains, also called high-hazard flooding areas. Building to these specifications helps property owners lower their flood insurance premiums, according to the county.

The impacts are “unavoidable,” per the report. The changes are slated to be adopted next month after a public hearing, which the Arlington County Board authorized over the weekend. The new maps, restrictions and building requirements go into effect Nov. 16.

Despite the increases it documented, the county emphasizes the number of affected properties is low.

Only 25% of buildings in a 500-year floodplain, or 150, are non-residential and stand to be potentially impacted by the use restrictions on emergency services, healthcare facilities and government records storage. Some 714 parcels are expected to be impacted by the restrictions on accessory structures.

The report attributes the few affected properties to a longstanding county policy to buy land in floodplains to “discourage unwise development.” Arlington prohibits construction within 15 feet of 100-year floodplain boundaries. FEMA also calls these zones special flood hazard areas and requires owners of property within them to get flood insurance.

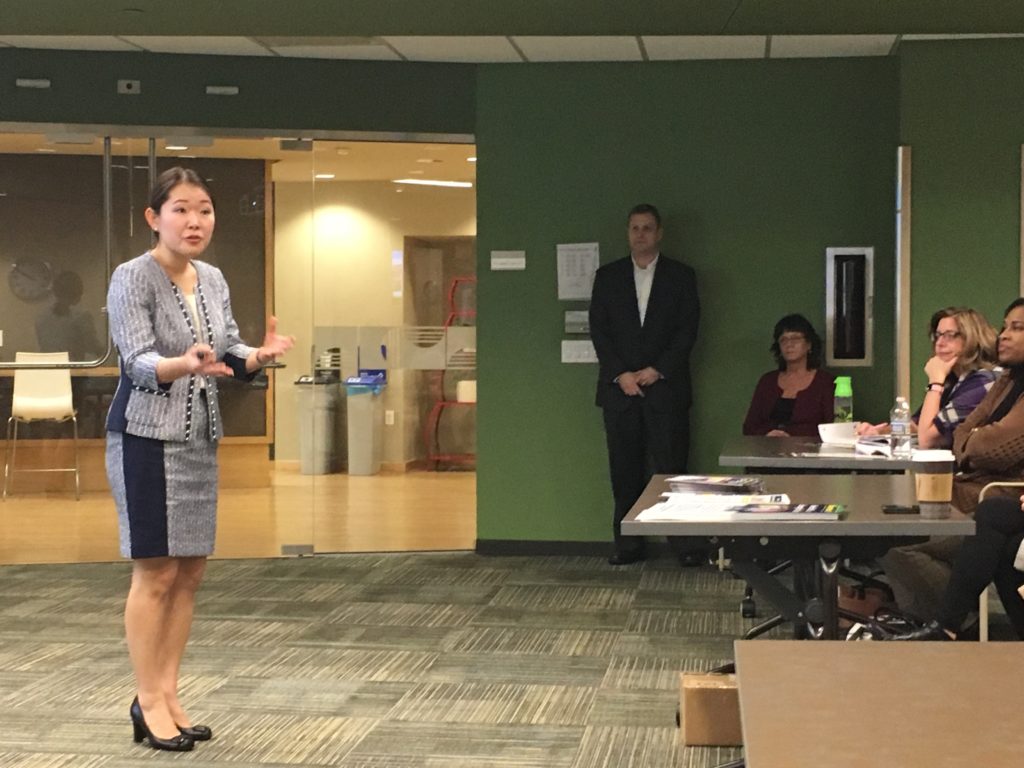

“Overall, most parcels and structures within the County are actually not impacted by these new floodplain maps,” Stormwater Communications Manager Aileen Winquist told ARLnow. “Due to Arlington’s extremely forward thinking past policies, many flood prone properties were acquired for parkland.”

The county’s first stormwater plan, from 1957, recommended local government buy land within floodplains.

“Implementation of this recommendation was ahead of its time, and as a result, relatively few properties in Arlington are in the 100-year floodplain,” the county report says. “Instead of large-scale development in the floodplain, Arlington County has an extensive network of stream valley parks as a result of acquisition of stream valleys by the County.”

Crediting these that policy and the prohibition on new building close to flood zones, Arlington County says today, only 300 insurable structures now fall in FEMA’s new high-risk 100-year floodplain areas, comprising 0.6% of all structures in Arlington. Another 150 buildings are within 15 feet of the same boundaries.

The county contrasts itself with other jurisdictions that have relied more on flood-control infrastructure, such as levees, and disaster relief for flood victims.

“This approach did not reduce losses… and this strategy did not discourage unwise or risky development,” the report said. “In fact, it may have actually encouraged additional development in areas of high risk.”