Have you ever showed up to a date and realized you had been stood up?

The Arlington County Board nearly did yesterday (Thursday) during a hearing on the proposed property tax rate.

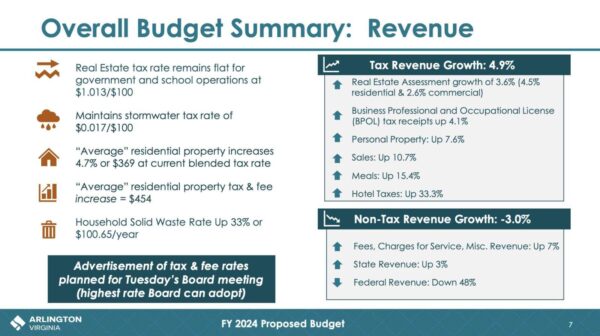

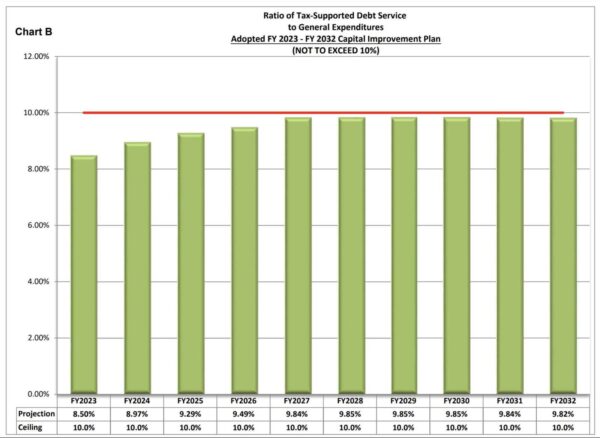

The county proposes a rate of $1.013 per $100 in assessed value. While flat over last year, the average Arlington homeowner would still see taxes go up $454, owing to rising residential property assessments and other fees.

“Madame Clerk, do we have any speakers this evening?” asked Board Chair Christian Dorsey.

“We do. We have one speaker,” said the clerk.

“Terrific,” he rejoined.

That speaker was Hamilton Humes, the commissioner of the Youth Ultimate League of Arlington, an ultimate frisbee league. Addressing the board in gear suggesting he had just been out slinging a disc — or would be soon — he expressed his thanks for the County Board’s work and approval for the fees levied to maintain local playing fields.

“We appreciate all the effort to provide playing fields,” said Humes. “I speak for all the youth athletic organizations to say that… The only issue, which is not in your purview, is the scheduling between Arlington Public Schools and the Dept. of Parks and Recreation, but you all know that.”

There was no mention of the property tax rate.

The Board took a break to wait for more speakers. Eventually, a man called in to ask why the real estate assessment on a church property he recently purchased along Route 50 had increased by more than 17% — compared to increases of 3.5.-5.5% in previous years.

He prefaced his brief comments by apologizing for possibly bringing this up in the wrong avenue, saying he had never done anything like this before. After he finished speaking he was informed that it was, in fact, the wrong venue for challenging property assessments.

“We have a no wrong door policy,” Dorsey assured him. “We’ll be sure to communicate with you via email about the exact route for [appealing the tax assessment]. We’re happy you joined us however you come to us.”

Last night’s meeting is a far cry from Missing Middle hearings last week, which saw north of 200 speakers, as well as yesteryear’s tax rate hearings. A hearing in 2010 drew 26 speakers, the most of any meeting dating back to 2008 with minutes available on the county website.

In these meetings, people often requested higher taxes to cover school spending or affordable housing, while others have advocated for lower tax rates or holding the current tax rate steady to provide relief to people on fixed incomes and small business owners. Those opposed to tax hikes would often also speak in favor of reducing county spending.

The number of speakers has since declined to seven, four and six speakers in 2020, 2021 and 2022, respectively — years that coincided with introspection and concern about the county’s pathways for citizen engagement, called the “Arlington Way.”

Meeting minutes showed about a half-dozen people who used to speak reliably against increases: In first place, with at least eight appearances, is former independent Congressional candidate Jim Hurysz; in second is former independent County Board candidate Audrey Clement, with at least seven.

While lacking in speakers passionate about taxes and county finances, the meeting had one memorable moment.

Arlington’s youngest-ever Sergeant-At-Arms — County Board member Katie Cristol’s son — banged the gavel to start the hearing at 7 p.m. As he continued banging the gavel, Cristol intervened.

“Okay, you don’t have to keep doing it,” she said.

He happily sat on Cristol’s lap, sipping juice until his father took him home. Board members continued chatting among themselves between the speakers and the adjournment at 8 p.m. sharp.